What Does Reversionary Pension Mean

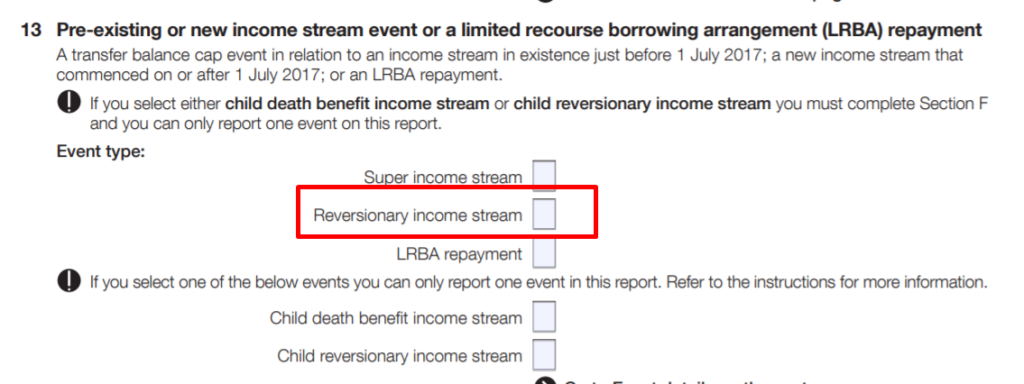

In effect its a. The Australian Taxation Office ATO de-scribes a reversionary pension as follows without actually using the term reversionary.

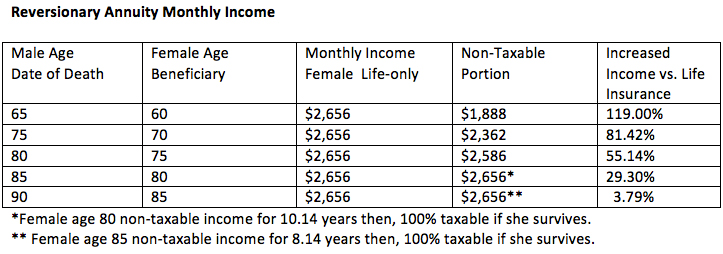

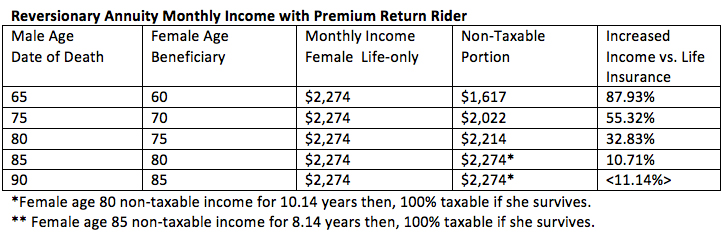

Reversionary Annuities Gary S Mettler

That which is to be received in reversion.

What does reversionary pension mean. Reversion law an interest in an estate that reverts to the grantor or his heirs at the end of some period eg the death of the grantee. To be enjoyed in succession or after the termination of a particular estate. Reversionary definition of relating to or involving a reversion.

How does it work. When a SMSF member has a pension in place one means of passing his or her superannuation to a specific beneficiary is to make that pension reversionary. Your pension will be reversionary if a decision was made at the commencement of the pension for it to be reversionary AND the pension documents eg.

Trust deed request for pension trustee minutes and pension terms and conditions make this clear. A reversionary pension is an income stream pension that automatically passes to the reversionary beneficiary upon death of the original owner of the pension. A reversionary pension is an income stream you set up with your superannuation that automatically continues to someone else generally your spouse when you die.

Reversionary v non-reversionary pensions. Under the Pension Payment Agreement a reversionary beneficiary is the person who will continue to receive a members pension when the member dies subject to an important qualification below. That is the superannuation income stream continues with the entitlement to it passing from one person the member to another the dependant beneficiary.

Of or pertaining to a reversion. When the primary beneficiary dies and the trustee exercises a limited discretion to pay a benefit as an INCOME STREAM to a new beneficiary then the relevant number is the new beneficiarys life. Reversionary interest is a condition in a trust where the original owner of a property can claim it back after transferring it to a beneficiary.

A reversionary pension is one way you can transfer the balance of your super pension on to an eligible beneficiary. If you nominate a person to be your reversionary beneficiary when you die whilst still in receipt. However there is a 12 month window from death before this amount is included against the beneficiarys cap.

By Meg Heffron BEc FIAA. A reversionary pension is a pension that automatically reverts. What does it mean if a pension is reversionary.

Conclusion When applying for the Age Pension an SMSF trustee may be required to report the relevant number of their pension interests to Centrelink. Assets remain in the super system With a reversionary pension the assets supporting the pension payments remain within the beneficial tax environment of the super system. This means that in the event of your death the Account-Based Pension will automatically continue to be paid to your wife.

Where the directions are that the income stream is to revert to the reversionary beneficiary the income stream retains the purchase price and commencement day of the original income stream. In this case the existing reversionary beneficiary nomination will be lost and a new nomination will be required. As a general rule where the proceeds of an insurance policy are expected and will be added to a pension after the death of the original pensioner a reversionary pension would appear to provide the best results from the point of view of the taxable and tax free proportions.

The trustees recorded the account-based pensions relevant number to be 2689. A reversionary pension automatically continues being paid on death to a nominated dependant the pension does not cease. The primary advantage of this election is that the Account-Based Pension seamlessly transfers to your wife.

A superannuation income stream ceases as soon as a member in receipt of the superannuation income stream dies unless a depend-. This paper provides the crucial must know details. As a reversionary interest or right.

A reversionary death benefit income stream is a superannuation income stream that reverts to the reversionary beneficiary automatically upon the members death. If the death benefit is paid as a lump sum your beneficiary may be unable to recontribute the money back into the super system. You have elected to have your wife as a Reversionary Pensioner for your Allocated Pension Account-Based Pension.

A reversionary pension beneficiary is a person who will receive an income stream pension when the original owner and recipient of the pension passes away. As the pension is automatically reversionary the relevant number is the greater of Mark and Mandys relevant number. Pension commutation means that the member chose to give up part or the entire pension payments from retirement in exchange for an immediate lump sum withdrawal.

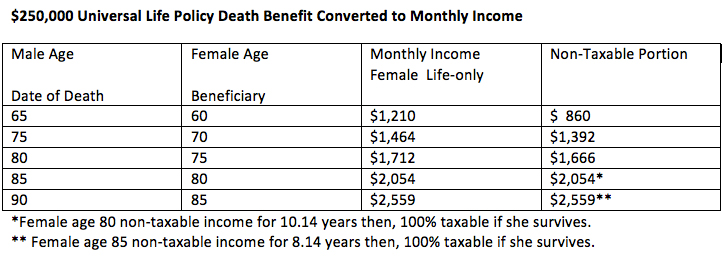

The value of a reversionary pension will count towards a spouses transfer balance cap - the limit which restricts how much money a person can have in tax-free pensions - based on the value of the pension at date of death. It is also known as reversion to. The term reversionary annuity refers to a retirement income strategy that combines an insurance policy with an immediate annuity to provide for.

The SMSF trustee may only pay the pension to a reversionary beneficiary if the person is a pension dependant explained below of the deceased member.

How Well Have You Structured Reversionary Pensions Under The Super Reforms Smarter Smsf

Alpha Architect Pension Fund Pensions Fund

Reversionary Annuities Gary S Mettler

Retire In Home Participants And Objectives Different From Home Reversion Download Scientific Diagram

Reversionary Annuities Gary S Mettler

The Mean Reversion Cfa Frm And Actuarial Exams Study Notes

What Is A Reversionary Pension Leading Smsf Law Firm

Posting Komentar untuk "What Does Reversionary Pension Mean"