How To Find Lost Trn Number In Gst

Check GST Registration Status via ARN number. Information submitted above is subject to online verification before proceeding to fill up Part-B.

Gst Registration Status How To Track Gst Status Quickbooks

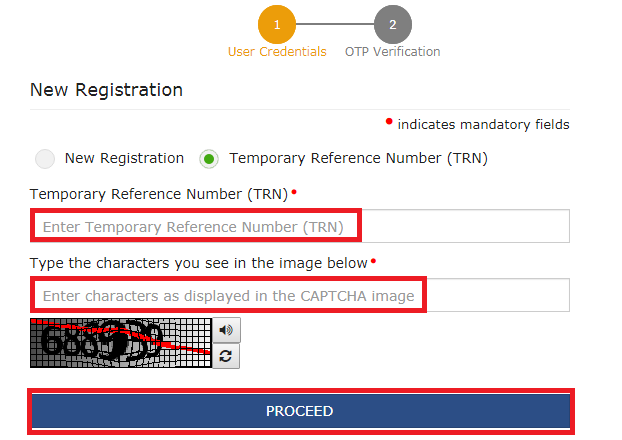

Application Status Using TRN.

How to find lost trn number in gst. Write it down or save it in notepad for future useIf you did not write TRN or have forgotten valid TRN you can access it from the mail. Permanent Account Number PAN Email Address. Select the Temporary Reference Number TRN option.

The next involves entering the ARN number and pressing the Search button. Will be issued or query can be raised. Call the Teaching Regulation Agency on 020 7593 5394.

Access the httpswwwgstgovin URL. Youll need to provide your full name date of birth and National Insurance. Either contatc concerned TIN Fc center where you have filed returns or you can also get information from department if you write letter to it.

Goods and Services Tax GST is an indirect tax throughout India to replace taxes levied by the central and state governments How to use TRN number under GST registration important notes. Enter details in Step-1 and Step-2 of the form. ARN Application Reference Number status is the official proof that you have successfully applied for GST registration.

After clicking on the Services tab now click on Track Application Status. The GST Home page is displayed. Answered 3 years ago Author has 171 answers and 293K answer views.

The first step is to access the home page of the GST portal at wwwgstgovin. In Step-3 registered mobile number of the deductor as in TRACES profile will be displayed. Open GST portalusing the linkhttpsreggstgovinregistration.

You have to fill full form and has to submit required documents online and then you have to verify it by EVC to validate form and within 3 days after validation either gst no. Make sure you have your National Insurance number ready before you call. If you dont know what your teacher reference number TRN is this can usually be found on your payslip or teachers pension documentation.

After selecting SRN fill the SRN in the SRN field and captcha text in Type the characters you see in the image below field. Follow the steps given below. The Temporary Reference Number TRN is sent to your registered mobile number and e-mail address.

Click the REGISTER NOW link. TRN is messaged or mailed only after the completion of the Registration. You can check your email you must have received in.

Requirements for Application and Registration. To track status of registration application after logging to the GST Portal using Temporary Reference Number TRN perform the following steps. Manjula Moorthy Qualified CS CA Finalist 04 December 2017.

For every application or form on GST site TRN ARN is generated. Incase you have forgotten your TRN or did not write it down then check you mail id or SMS on the mobile number provided at the time of filling details of part A. OTP will be sent to this Email Address.

Site best viewed at 1024 x 768 resolution in Internet Explorer 10 Google Chrome 49 Firefox 45 and Safari 6. Now that I want to register as GST Practitioner also using same PAN Email mobile the system is asking to login using TRN generated in the first place. You can also contact the teacher qualifications help desk to request your number.

The GST Home page is displayed. Select Type of User as deductor. A TRN Registration Certificate and Data Sheet will subsequently be issued upon assignment of a Confirmed TRN.

Access the httpswwwgstgovin URL. CA Mayur Todmal Practicing CA 30 November 2017. Unable to retrieve trn temporary reference number On around 22nd April With my PAN mobile and email Id i created one GST account as tax payer and got GST number also.

Go to Services - Registration - Click on Track Application Status. You know that you can find GST number of any business or organization by simply typing the name of the company or with initial letters of the organization. It was introduced as The Constitution One Hundred and Twenty Second Amendment Act 2016 following the passage of Constitution 122nd Amendment Bill.

Mobile number and Email address. Type OTPs sent to your mobile no and proceed. Application Status will be displayed along with Status Guide.

In the Temporary Reference Number TRN field enter the TRN received. You lost TRN of which form. GST Registration on GST Portal.

Enter the correct name of the business Type at least 10 characters to find relevant GST Number information. Thus you can track your application status by choosing SRN option. Go to the wwwgstgovin.

Dear Bruce You can write to or apply online. File Clarification within 7 working days of date of notice on portal. Log Out From the site.

You w ill be re directed to Dashboard of GST. It is a unique number that can be used to track the online status of your GST portal registration application. On clicking Search the application status gets displayed.

On clicking Proceed One-Time Password OTP will be sent to the mobile number. Clarification filed-Pending for Order. Email Address is required Enter valid Email Address.

Notice for seeking clarification issued by officer. User can edit the mobile number on the screen. Select the Temporary Reference Number TRN option.

With the help of TRN NO. ARN number is basically used for checking GST registration status online. Visit the GST Portal.

However you wont be able to get the card without visiting the office or the physical assistance of someone in Jamaica. Separate OTP will be sent to this mobile number. Steps to keep in mind while Searching GST Number by Name.

You can track the application status by using the TRN. ARN is a 15 digit number sent on applicants email when the application is submitted. Finding your teaching reference number.

The second step is to click on the Services tab on the top bar. Request a TRN reminder by phone. Organizations should complete an Application for Taxpayer Registration Number Organizations and submit same with the relevant documentation.

Enter your ARN Application Reference Number received on registered e-mail id. If you cannot retrieve TRN from Mail or phone due to any reason you need to fill in all the details in PART A of the Registration Application again. Click the REGISTER NOW link.

Click the PROCEED button. The card cannot be sent from that office to you so either you come to Jamaica for the card or rely on someone to go in and collect it. Pending with Tax Officer for Processing.

How To Fill Part A Application For Gstin Register For Trn Number Registered Reference Numbers

Pending For Gst Clarification Application On Gst Portal Learn By Quickolearn By Quicko

Gst Registration Status How To Track Gst Application Status

Gst Registration Status How To Track Gst Application Status

Gst Registration Status How To Track Gst Application Status

Gst Registration Status How To Track Gst Status Quickbooks

Gst Registration Status How To Track Gst Application Status

Posting Komentar untuk "How To Find Lost Trn Number In Gst"