Reversionary Pension Vs Binding Nomination

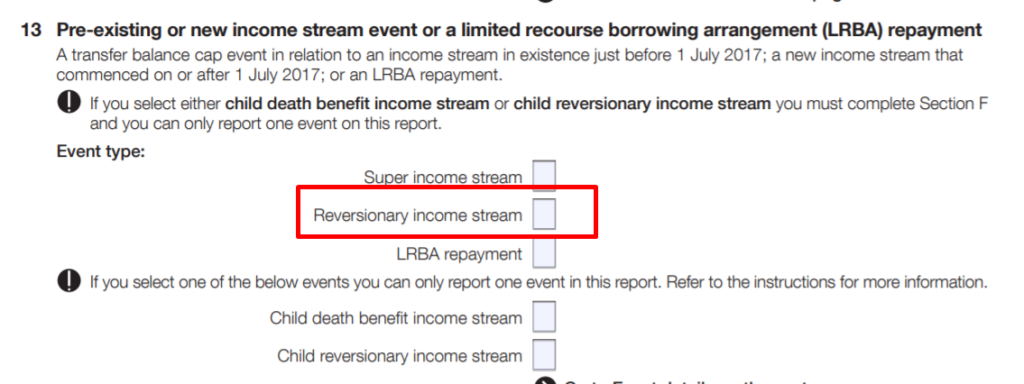

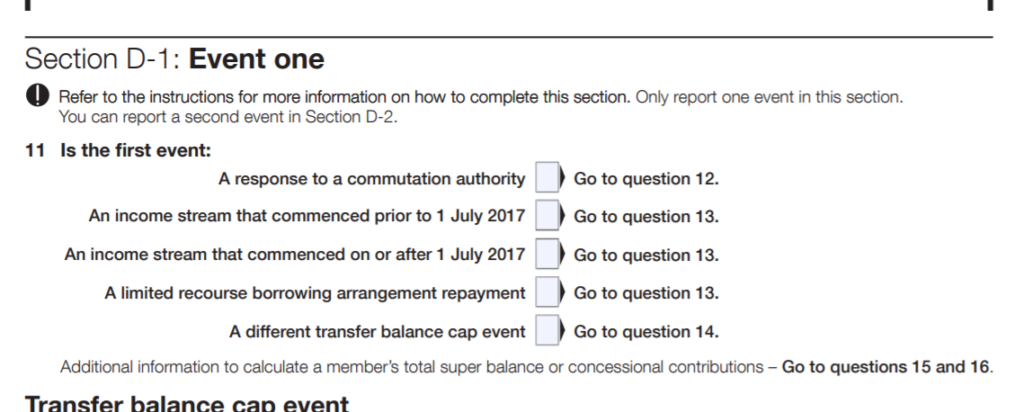

Payment of the death benefit as a pension gives rise to a credit under the transfer balance account when the surviving beneficiary becomes entitled to be paid the death benefit income stream. A death benefit arrangement mdash it can be either a Death Benefit Nomination binding or non-binding or a Death Benefit Agreement see the end of this article for an explanation of the difference.

How Well Have You Structured Reversionary Pensions Under The Super Reforms Smarter Smsf

What is the difference and why are they not the same instructions.

Reversionary pension vs binding nomination. Under SUPERCentrals governing rules a reversionary pension if properly set up will prevail over an equally valid binding death benefit nomination to the extent that they are inconsistent. One of the limitations of a Reversionary Pension is that the Reversionary Pension beneficiary cannot be a Legal Personal Representatives or children over 18 years of age. Where a pension is reversionary a binding death benefit nomination is still relevant as.

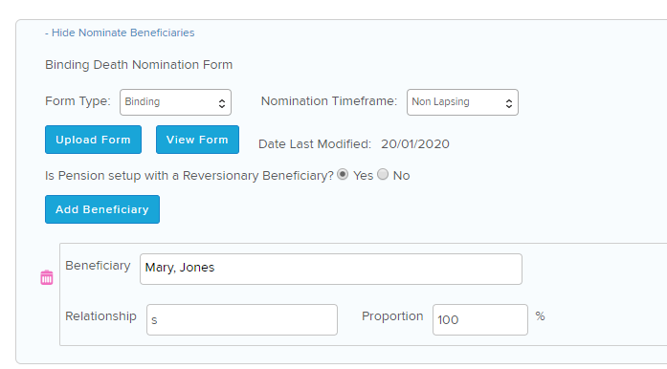

Reversionary pension vs binding death benefit nomination One of the key benefits of a reversionary pension is the automatic nature of the change in recipient with the fund trustee not required to make a decision about the benefit other than confirming your nomination. Therefore in some circumstances a Binding Death Benefit Nomination will be required to ensure that death benefits are paid to the Legal Personal Representative or adult children. With the introduction of the super reforms on 1 July 2017 it is time to revisit the key differences and considerations when deciding whether to have an automatically reversionary nomination or a binding non-lapsing death benefit nomination for account-based income streams.

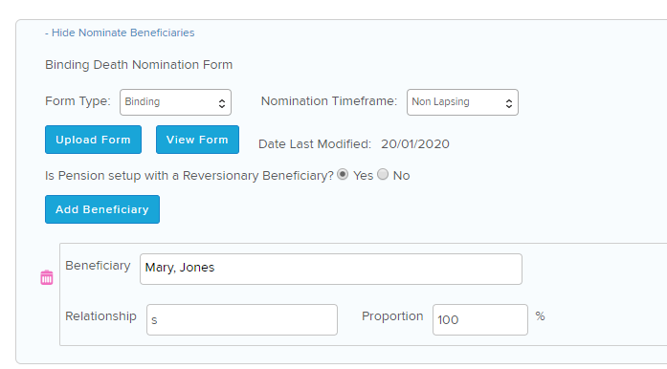

There is a misconception that reversionary pension documentation will always apply before a binding death benefit nomination. A Binding Death Benefit nomination is an instruction to the Trustee of the Superannuation fund by the member on who is to receive their Superannuation benefits when the member dies. Binding Nominations usually need to be renewed every 3 years unless they are a Non-lapsing Binding Death nomination which as the name infers does not expire.

Ad Ours is a highly qualified team of British-trained and experienced specialist advisers. Some newer SMSF deeds are more flexible so again it is important to read the deed. The alternative is a non-binding nomination where the Trustee has the.

A reversionary pension cannot bind the trustee as the allocation when there is no binding death benefit nomination in place is the trustees discretion and the member cannot exercise that discretion or impose restraints or fetters on that discretion. However in the Allocated Pension my wife is a Reversionary Beneficiary. Reversionary Pension vs Death Benefit Nomination Pension 28022018 The superannuation advisory industry is still coming to grips with the effect of the 1 July 2017 changes to superannuation laws that have changed the definition of death benefit and limited the tax benefits of pension accounts which exceed 16 million.

One of the limitations of a Reversionary Pension is that the Reversionary Pension beneficiary cannot be a Legal Personal Representatives or children over 18 years of age. The nominated reversionary pensioner may predecease the member in which case the reversion cannot operate and so the binding death benefit nomination will apply. A binding nomination will be more appropriate if a client wants to nominate more than one SIS dependant.

Therefore in some circumstances a Binding Death Benefit Nomination will be required to ensure that death benefits are paid to the Legal Personal Representative or adult children. If the SMSF deed is silent on the question it can be entirely possible at times that the binding death benefit nomination BDBN will apply before any reversion pension documentation. There is a misconception that reversionary pension documentation will always apply before a binding death benefit nomination.

Binding death benefit nomination gives you certainty that your superannuation benefit will be paid to the beneficiary you nominate there is no trustee discretion. Under the SUPERCentrals governing rules a reversionary pension if properly set up will prevail over an equally valid binding death benefit nomination to the extent that they are inconsistent. The terms of a reversionary pension are agreed to.

If a clients circumstances or preferences change prior to their death they can amend their binding nomination at any time. With a reversionary beneficiary nomination a single eligible beneficiary can only continue the income stream. There is a misconception that reversionary pension documentation will always apply before a binding death benefit nomination.

For members of large super funds reversionary pensions and binding death nominations provide broadly the same certainty that the right beneficiary will receive the deceased members super on death. However with most SMSFs you cannot change the nomination and must instead commute the current pension withdraw a lump sum payment and commence a new pension with a new reversionary nomination or with a binding death benefit nomination. However members of SMSFs may have more certainty through the use of a reversionary pension.

If the SMSF deed is silent on the question it can be entirely possible at times that the binding death benefit nomination BDBN will apply before any reversion pension documentation. If the SMSF deed is silent on the question it can be entirely possible at times that the binding death benefit nomination BDBN will apply before any reversion pension documentation. We specialise in dealing with the retirement planning needs of global expatriates.

The credit is equal to the commencement value of the death benefit pension. Reversionary beneficiary the nominated person generally a spouse will automatically continue receiving the pension after your death. A binding nomination is a more formal and considered document than the terms of a pension.

A pension that names a reversionary beneficiary. Differences between an automatic reversionary and a binding nomination arrangement. Most deeds say that a binding death benefit nomination takes precedence over a reversionary pension although some choose to go the other way.

Most deeds say that a binding death benefit nomination takes precedence over a reversionary pension although some choose to go the other way.

Account Based Pensions Binding Vs Reversionary Nominations Money Management

Reversionary Pension Vs Bdbn Which Outcome Is Preferred

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

Reversionary Pension Vs Bdbn Which Outcome Is Preferred Leading Smsf Law Firm

How Well Have You Structured Reversionary Pensions Under The Super Reforms Smarter Smsf

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

Posting Komentar untuk "Reversionary Pension Vs Binding Nomination"