Rbi Rules For Nomination

The RBI said the banks shall have a Board approved policy for settlement of claims. The procedure for breaking open of a locker is done in the presence of the.

Online Safe Banking Rbi Advisory Icici Bank

Losing of the locker key or.

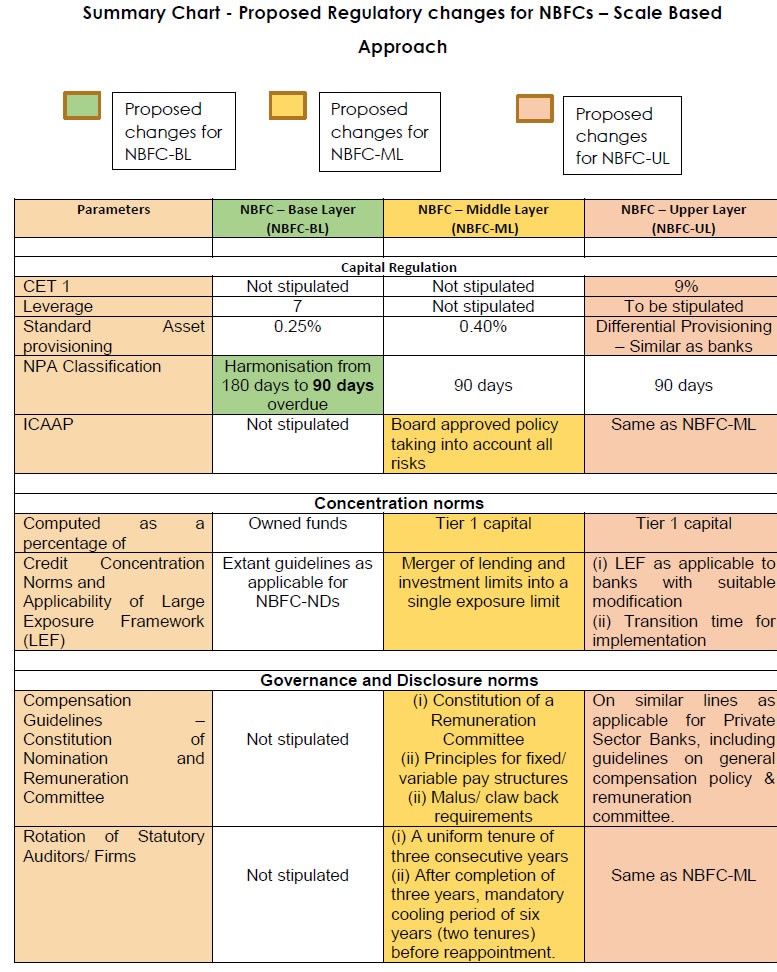

Rbi rules for nomination. Sebi rules for new trading accounts Investors who open a new trading and demat account from October 1 now have the choice of providing nomination or opting out nomination. It has also asked the banks to formulate policy for nomination and release of contents of safety lockerssafe custody articles to the nominee and protection against the notice of claims of other persons. The contents have to be released within 15 days of the death of the depositor.

Death of the locker hirer without nomination or. Banks shall have a Board approved policy for nomination and release of contents of safety lockers safe custody article to the nominee and protection against notice of claims of other persons in accordance with the provisions of Sections 45 ZC to 45 ZF of the Banking Regulation Act 1949 and the Banking Companies Nomination Rules 1985Co-operative Banks Nomination Rules. In case they fail to do so their demat accounts will be frozen.

The Rules 2 10 3 9 and 4 10 require a bank to register in its books the nomination cancellation andor variation of the nomination. The existing holders of such accounts will need to provide choice of nomination by March 31 2022. H 90221301299 2011-12 DATED 1-7-2011.

3 Where the nominee is a minor it shall be lawful for the depositor making the nomination to appoint in the manner prescribed by rules made by the Central Government under section 45ZA of the Banking Regulation Act 1949 10 of 1949 any person to receive the amount of deposit in the event of his death during the minority of the nominee. 511 The banks shall offer nomination facility in case of safe deposit lockers and safe custody of articles in accordance with the provisions of section 45-ZC to 45-ZF of the Banking Regulation Act 1949 and Banking Companies Nomination Rules 1985Co-operative Banks Nomination Rules 1985. If there is a nominee the bank will simply transfer the funds to the nominees account without insisting on a court order succession certificate or letter of administration.

The banks should accordingly take action to register nominations or changes therein if any made by their depositor s hirer s of lockers. Forms for cancellation and variation of the nominations. New RBI locker rules on settlement of claims.

The Nominator may only nominate a Nominee who. A is currently living personally known to the Nominee and at least eighteen 18 years old and legal age of majority in hisher jurisdiction of residence. Inactive locker for more than a specified period of time.

The Department of Government and Bank Accounts Central Office RBI has been issuing instructions relating to nomination facility for ReliefSavings bond holders from time to time. The Rules 2 10 3 9 and 4 10 require a bank to register in its books the nomination cancellation andor variation of the nomination. The role of nominee arises only on the death of all the depositors.

Customerlegal heirnominee as the situation may be Advocate of the bank. The Banking Companies Nomination Rules 1985 Clarifications Please refer to para 1 of our Circular DBODNoLegBC8309070052010-11 dated March 30 2011 on the captioned issue wherein we have clarified that signatures of the account holders in forms DA1 DA2 and DA3 need not be attested by witnesses. A nomination in banking terms refers to an account holders right to appoint one or more persons who are entitled to receive the money in case of the death of the account holder.

B is a legal resident of the United States including its commonwealths territories and possessions or Canada excluding the Province of Quebec and the coach of a youth baseball or softball team which is formally affiliated with the RBI. The existing holders of such accounts will need to provide choice of nomination by March 31 2022. Registration of Nominations and cancellation and variation of nominations and.

In this regard banks could consider adopting either of the following two approaches. In case they fail to do so their demat accounts will be frozen. As per RBI guidelines there is no mention of linking savings or current account with the locker for rent recovery.

In order to avoid hardship to the survivors nominee of a deposit account banks are advised to obtain appropriate agreement authorization from the survivors nominee with regard to the treatment of pipeline flows in the name of the deceased account holder. The Banking Companies Nomination Rules 1985 framed under Banking Regulation Act 1949 enables banks to pay the amount standing to the credit of the deceased depositor to his nominee. I name and address nominate the following person to whom in the event of.

In order to ensure that the articles left in safe custody and contents of lockers are returned to the genuine nominee as also to verify the proof of death banks shall devise their own claim formats in terms of applicable laws and regulatory guidelines RBI said. The nomination form contains a column for witnesses of the nomination thus making it necessary that a physical form is submitted. The contents have to be released within 15 days of the death of the depositor.

In case the nominee is a minor the same procedure as. Locker hirer can add cancel or modify a nominee by filling relevant forms this is as per banking nomination rules 1985 For sole hire locker one nomination can be made. Nomination under section 45ZC of the Banking Regulation Act 1949 and Rule 31 of the Banking Companies Nomination Rules 1985 in respect of articles left in safe custody with banking company.

The RBI however may change the rules to provide nomination through net banking and without requirement of any witness. One witness usually another customer of long standing and repute. In order to ensure that the articles left in safe custody and contents of lockers are returned to the genuine nominee as also to verify the proof of death banks shall devise their own claim formats in terms of applicable laws and regulatory guidelines RBI said.

Two nominations can be done in case of joint locker-hirers. RemittanceTransfer of Funds to Non-Resident Nominees. The banks should accordingly take action to register nominations or changes therein if any made by their depositor s hirer s of lockers.

The Banking Companies Nomination Rules 1985 which are self-explanatory provide for-Nomination Forms for deposit accounts articles kept in safe custody and contents of safety lockers. Customers must visit the bank branch physically and provide necessary nomination details. 211 Access to the safe deposit lockers return of safe custody articles with survivornominee clause 2111If the sole locker hirer nominates a person banks should give to such nominee access of the locker and liberty to remove the contents of the locker in the event of the death of the sole locker hirer.

The forms prescribed for deposit accounts under the nomination Rules are Form DA 1 for nomination Form DA 2 for cancellation and Form DA 3 for variation. Basically RBI says that in the case of a joint deposit account the nominees right arises only after the death of all the depositors. RBIs Master Circular dated 1-7-2011 on Nomination facility in Relief Savings Bonds.

It also says there cannot be more than one nominee in respect of a joint deposit account Making Claim as a Nominee.

Rbi Issues New Guidelines For Locker In Banks

Reserve Bank Of India Publications

Reserve Bank Of India Frequently Asked Questions

Rbi Tightens Rules For Selection Of Elected Directors On Bank Boards Business News The Indian Express

Bank Fixed Deposit Fd What To Do When Depositor Dies Before Maturity Basunivesh

It S Time To Revisit Nomination Rules For Bank Deposits The Federal

Posting Komentar untuk "Rbi Rules For Nomination"