How To Track Gst Trn Number

ARN status will help existing taxpayers to migrate them into new Goods and Services Tax GST. ARN Generated - Status of Temporary Reference Number TRN.

How To Check Gst Registration Status

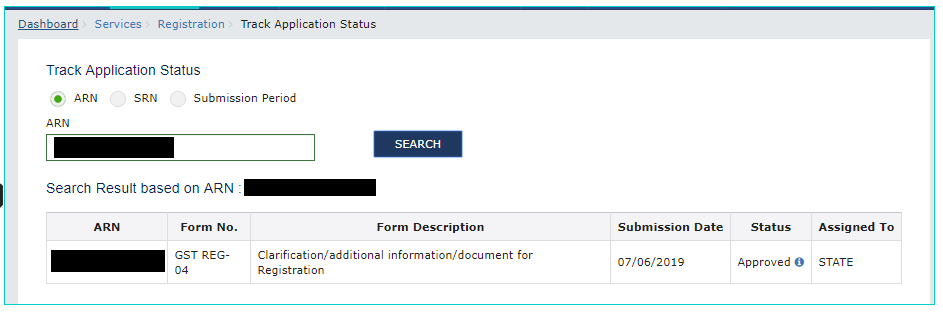

There are different application status types that you must know as follows.

How to track gst trn number. Write it down or save it in notepad for future useIf you did not write TRN or have forgotten valid TRN you can access it from the mail. Click on the Temporary Reference Number TRN. Select the Temporary Reference Number TRN option.

Click the REGISTER NOW link. When you successfully submit Part A of your application for GST Registration you will receive a TRN Temporary Reference Number on registered mobile and email. Select Services the option Track Application Status should appear.

OTP will be sent to this Email Address. Permanent Account Number PAN Email Address. Application for Cancellation of Registration.

The GST Home page is displayed. Now you need to Login into GST Portal via TRN Number. Application for Revocation of Cancelled.

GST stands for Goods and Services Tax is a centralized taxation system. We move to the new registration page. Application for Extension of Registration period by CasualNon Resident Taxable Person.

After selecting SRN fill the SRN in the SRN field and captcha text in Type the characters you see in the image below field. Click the PROCEED button. To track status of registration application after logging to the GST Portal using Temporary Reference Number TRN perform the following steps.

Type OTPs sent to your mobile no and proceed. Access the httpswwwgstgovin URL. How to Track GST Registration Application Status Online Track GST by ARN TRN.

Track status of invoice data to be shared with ICEGATE. Within that time you have to submit your complete gst form. Select the Temporary Reference Number TRN option.

The current status of your application should be displayed. Mobile number and Email address. Intimation on account of Refund not received.

The Temporary Reference Number TRN is sent to your registered mobile number and e-mail address. Track Application Status Track Application Status Track Application Status. Go to Services New Registration Select Temporary Reference Number.

Email Address is required Enter valid Email Address. Track Application Status Track Application Status Track Application Status. TRN number in gst is valid for fifteen days.

The GST Home page is displayed. Track Application Status Track Application Status. Thus you can track your application status by choosing SRN option.

Services Registration New Registration. To track status of registration application after logging to the GST Portal using Temporary Reference Number TRN perform the following steps. Clarification filed-Pending for Order.

To view status of new registration application at post-login TRN navigate to Services Registration New Registration select the Temporary Reference Number TRN. Click the Register Now link. You will get 15-digit Transaction Reference Number TRN.

File Clarification within 7 working days of date of notice on portal. In the Mobile Email OTP field enter the OTP you received on your mobile number and. Select the Temporary Reference Number TRN option.

In the Temporary Reference Number TRN field enter the TRN received. To view status of your registration application lost-login login to the GST Portal and navigate to Services Track Application Status option. Open the URL httpswwwgstgovin.

Go to Services - Registration - Click Track Application Status you can search the status of application using TRN. Click the REGISTER NOW link. TRN is messaged or mailed only after the completion of the Registration.

Please click hereto resend the Email and SMS. After submitting the enrollment application successfully at the GST System Portal ARN number will be created automatically. The GST Home page is displayed.

Visit the GST Portal. Pending with Tax Officer for Processing. You w ill be re directed to Dashboard of GST.

After logging into the GST Portal using Temporary Reference Number TRN follow the below steps to track the status of the GST Application after logging into GST Portal Step 1. Application for Cancellation of Registration. How to Track GST Registration Application Status Online Track GST by ARN TRN - YouTube.

A TRN number would have been received on your mobile and E-mail after submission of Part A of the GST registration form. Click the REGISTER NOW link. If you dont do this your TRN number will automatically cancelled after 15 days of its creation.

Access the httpswwwgstgovin URL. Select the Temporary Reference Number TRN option. Stock intimation for opting Composition Levy.

Notice for seeking clarification issued by officer. If you cannot retrieve TRN from Mail or phone due to any reason you need to fill in all the details in PART A of the Registration Application again. In Fact you also can use ARN for tracking the position of your enrollment application.

Follow the steps given below. You can track the application status by using the TRN. To track GST registration online the applicant should know the GST registration application number.

The Goods and Services Tax website is displayed. On clicking Search the application status gets displayed. If the applicant already knows the application number he can track the.

Separate OTP will be sent to this mobile number. Once the process is completed a message will be displayed You already have a TRN generated with this combination. Information submitted above is subject to online verification before proceeding to fill up Part-B.

This system has eliminated 23 different taxes at the state level and 17 taxes at the center level.

How To Track Gst Through Arn Application Reference Number

Check Gst Registration Status On Gst Portal Learn By Quickolearn By Quicko

Check Gst Registration Status On Gst Portal Learn By Quickolearn By Quicko

Gst Registration Status How To Track Gst Status Quickbooks

Gst Registration Status How To Track Gst Status Quickbooks

How To Register For Gst On The Gst India Portal A Step By Step Guide

Gst Registration Status How To Track Gst Status Quickbooks

Nice article i also have blog on same niche online opc registration Must Read it.

BalasHapus