What Is A Reversionary Beneficiary Nomination

Ing death benefit nomination may lead to unintended consequences. What s a reversionary beneficiary nomination.

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

Your reversionary beneficiary can.

What is a reversionary beneficiary nomination. Reversionary Pension Beneficiary. This nomination replaces any previous reversionary beneficiary non-binding or binding nomination made for the accounts you have selected on this form. If you d like the balance of your pension to be paid to one.

A reversionary nomination instructs AustralianSuper to continue to pay your pension account balance as a regular income to your nominated beneficiary if you die. If youre over age 65 the conditions for transition to retirement no longer apply and your account will become a Retirement income account. Due to a provision of the SIS Regulation constraints only certain dependants of the member can be reversionary beneficiary.

A Binding Death Benefit nomination is an instruction to the Trustee of the Superannuation fund by the member on who is to receive their Superannuation benefits when the member dies. In addition to a binding or a non-binding nomination a reversionary beneficiary nomination can be made when you use your super to start a superannuation pension such as an account based pension. If you are receiving an account-based pension from your superannuation its important to work out how the remaining balance of this pension will be distributed when you pass away.

Seek appropriate advice prior to amending your reversionary beneficiary nominations. What is a reversionary beneficiary nomination. A reversionary nomination means your beneficiary will continue to receive the income payments from your income account.

Automatic reversion nomination The SIS Regulations specifically allow account-based pensions that are payable for the life of both a primary and reversionary beneficiary. With a reversionary nomination because the pension payments continue to be paid to the beneficiary they dont have to make a choice at a time of grief and the funds are retained in the. A reversionary pension is one way you can transfer this balance on to an eligible nominated beneficiary.

This type of nomination can often provide certainty around the who and the how. 1 October 2020. A reversionary beneficiary nomination allows you to nominate one person who upon your death will continue to receive your ElectricSuper Income Stream payments as long as he or she is still an eligible Dependant at the time of your death.

You can return this completed form to. You may want to consider changing your nomination if your circumstances change so that your benefit will be paid in line with your current wishes. With a reversionary pension your existing super pension continues to be paid but it reverts to your beneficiary.

Minor child as a reversionary beneficiary While the normal course of action is to nominate a spouse as a rever - sionary beneficiary in some cases pensioners may want their pension to revert to other eligible beneficiaries such as financial dependants. To reversionary beneficiary nominations. Members can therefore commence an account-based pension that automatically reverts to a reversionary beneficiary upon the pensioners death.

The nomination must be to someone who is defined as a Dependant under the Superannuation Industry Supervision SIS act or your estate. A reversionary pension beneficiary is a person who will receive an income stream pension when the original owner and recipient of the pension. A reversionary nomination provides simplicity in that ownership of the income stream just transfers to the reversionary beneficiary.

This is different to a standard binding nomination where your beneficiary receives your death benefit as a lump sum. Making a pension reversionary also means theres no opportunity to pay the super to any other beneficiary. The SMSF trustee may only pay the pension to a reversionary beneficiary if the person is a pension.

A reversionary pension is an income stream pension that automatically passes to the reversionary beneficiary upon death of the original owner of the pension. What is a reversionary. Upon commencing a retirement income stream such as an account-based pension or a transition to retirement TTR pension your super fund may give you the option to nominate a reversionary beneficiary.

The nomination must be to someone who is defined as a Dependant under the Superannuation Industry Supervision SIS act or your estate. If you have more than one Income Stream account and you only want this nomination to apply to one of your accounts please. Transition to retirement income account Retirement income account Note.

AustralianSuper Locked Bag 6 CARLTON SOUTH VIC 3053 Questions. What is a reversionary nomination. UniSuper s Trustee is required by law to pay any remaining balance in your pension account to one or more of your dependants andor your legal personal representative if you die.

A reversionary nomination will provide greater certainty that the beneficiary will receive an ongoing income stream provided they are an eligible dependant at the time of death. A Binding Death Benefit nomination is an instruction to the Trustee of the Superannuation fund by the member on who is to receive their Superannuation benefits when the member dies. Reversionary beneficiary nomination Use this form to set up a reversionary nomination or changecancel an existing reversionary nomination.

For more information about beneficiary nominations please refer to the information available on our website at https. Reversionary beneficiary the nominated person generally a spouse will automatically continue receiving the pension after your death. REVERSIONARY BENEFICIARY NOMINATION FORM 1 REVERSIONARY BENEFICIARY NOMINATION FORM Tidswell Superannuation Fund Use this form to nominate a new or revoke an existing reversionary beneficiary for your Personal Pension account.

Under the Pension Payment Agreement a reversionary beneficiary is the person who will continue to receive a members pension when the member dies subject to an important qualification below. There is a separate form for standard binding nominations. Binding death benefit nomination gives you certainty that your superannuation benefit will be paid to the beneficiary you nominate there is no trustee discretion.

It enables you to select the person you would like to continue receiving the pension payments in the event of your death. A pension will be reversionary if the terms of the pension provide that on the death of the member the pension automatically transfers to another person usually called the reversionary beneficiary. A reversionary nomination makes it clear to the trustee of your super fund who you want to continue receiving your super pension if you die.

If you have an income stream you can choose to nominate a dependent as a reversionary beneficiary which allows your dependent to receive your money as an Income Stream or as a lump sum if you.

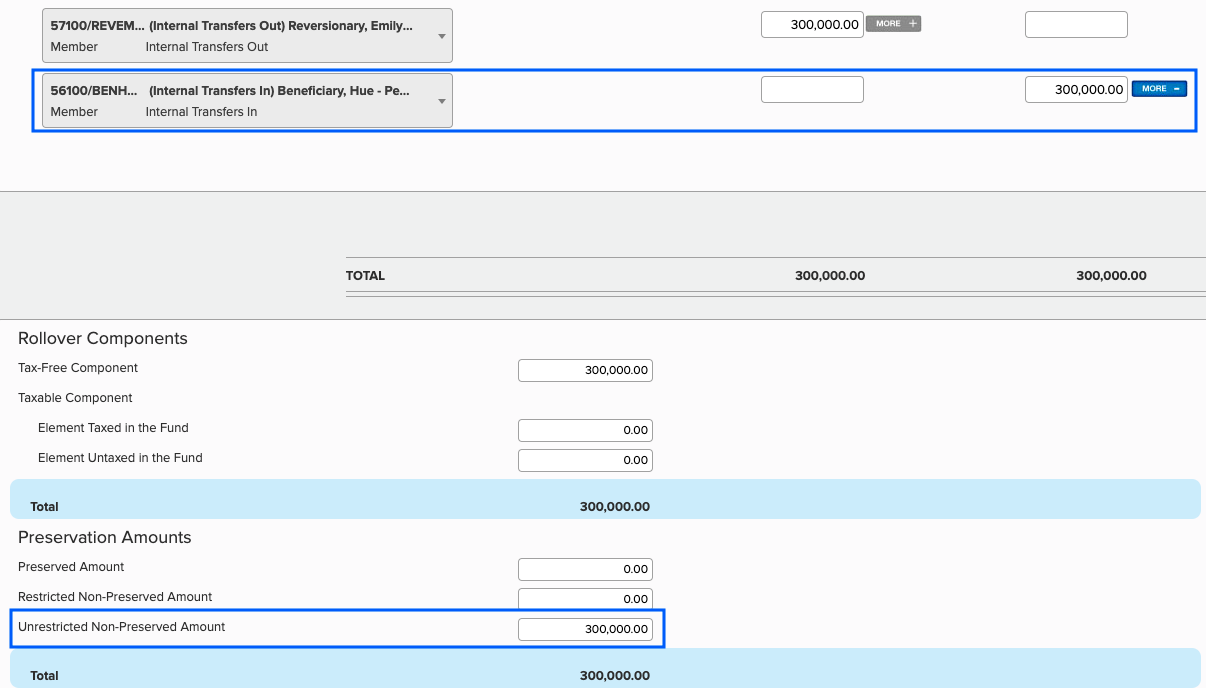

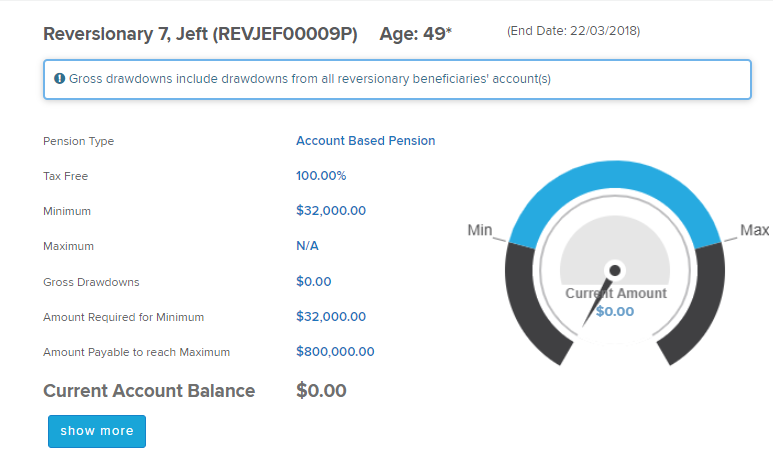

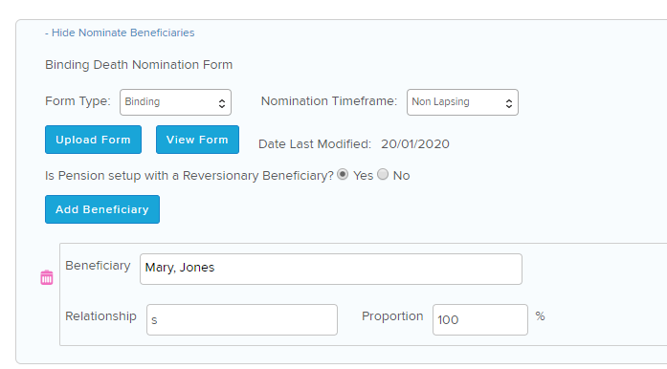

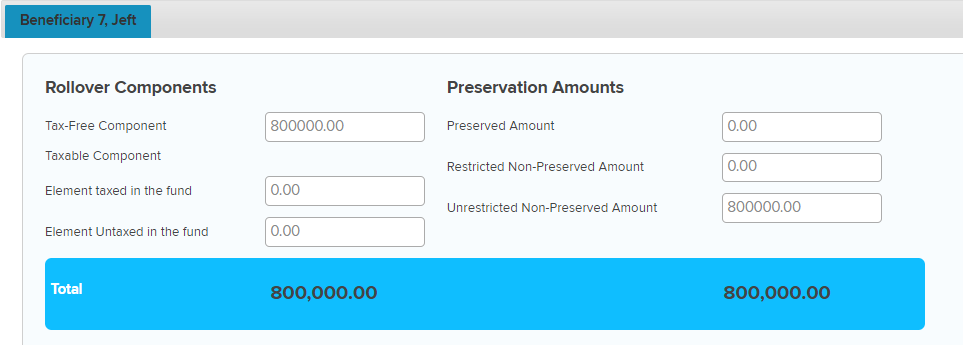

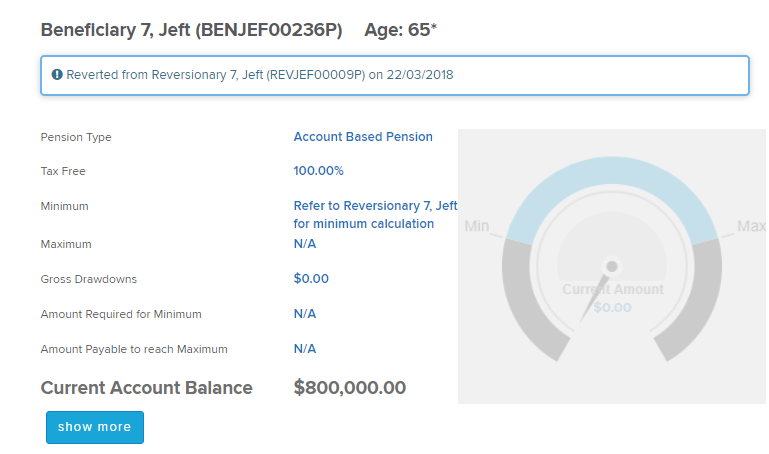

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

Posting Komentar untuk "What Is A Reversionary Beneficiary Nomination"