How To Find Trn In Gst

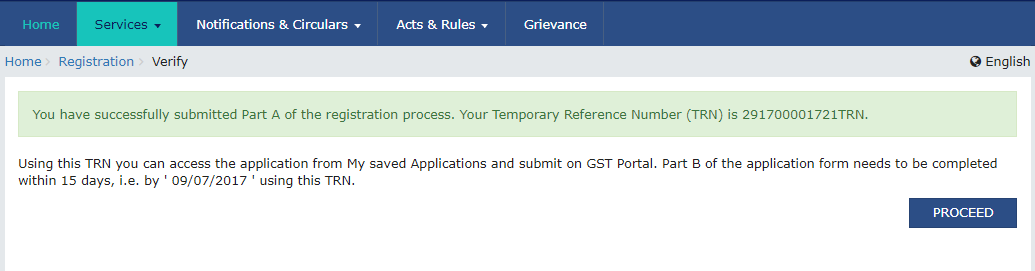

The GST Home page is displayed. Hello I started GST registration process and TRN was generated valid for 15 days.

Gst Registration Status How To Track Gst Application Status

How to Login after generating TRN temporary reference number in GST website - YouTube.

How to find trn in gst. Steps to keep in mind while Searching GST Number by Name. Goods and Services Tax GST is an indirect tax throughout India to replace taxes levied by the central and state governments How to use TRN number under GST registration important notes. Incase you have forgotten your TRN or did not write it down then check you mail id or SMS on the mobile number provided at the time of filling details of part A.

On inquiring with help deskthey appear to be clue less. Go to GST Portal Login to the GST Portal Navigate to New Registration Go to Services Registration New Registration Enter TRN Click on the option Temporary Reference Number TRN. Notice for seeking clarification issued by officer.

TRN is messaged or. Access the httpswwwgstgovin URL. Unfortunately system does not show the TRN.

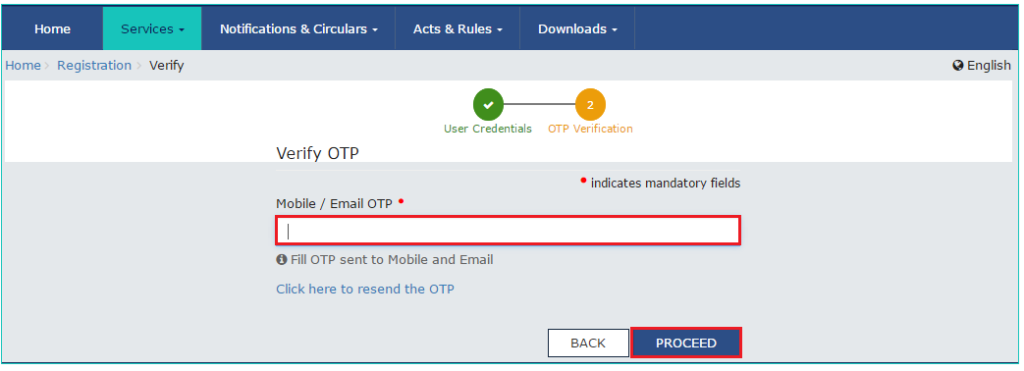

In the Temporary Reference Number TRN field enter the TRN received. In the Mobile Email OTP field enter the OTP you received on your mobile number and email address. GST Registration on GST Portal.

You know that you can find GST number of any business or organization by simply typing the name of the company or with initial letters of the organization. Write it down or save it in notepad for future useIf you did not write TRN or have forgotten valid TRN you can access it from the mail. Once the taxpayer fills all the details in part B an acknowledgement receipt in form GST REG-2 is sent to the taxpayer making such an application along with Application Reference Number ARN.

Access GST Portal at httpsgstgovin. PSrinivasan BCom 02 April 2018. Type OTPs sent to your mobile no and proceed.

To track status of registration application after logging to the GST Portal using Temporary Reference Number TRN perform the following steps. The Temporary Reference Number TRN is sent to your registered mobile number and e-mail address. OTP will be sent to this Email Address.

Go to this link httpswwwgstgovin Click on Existing User Login Button Enter ID Password and Captcha Click Continue Button on next page Click Saved Application on top tab Application Status will be displayed Also your ARN Number Status will be sent to your registered mobile number. GST Law. A TRN number would have been received on your mobile and E-mail after submission of Part A of the GST registration form.

It was introduced as The Constitution One Hundred and Twenty Second Amendment Act 2016 following the passage of Constitution 122nd Amendment Bill. Information submitted above is subject to online verification before proceeding to fill up Part-B. Go to Services New Registration Select Temporary Reference Number.

With the help of TRN NO. Ideally old TRN should have lapsed in 15 days. You have to fill full form and has to submit required documents online and then you have to verify it by EVC to validate form and within 3 days after validation either gst no.

OTP is valid only for 10 minutes. Select the Temporary Reference Number TRN option. Select the Temporary Reference Number TRN option.

Mobile number and Email address. Once the taxpayer fills details in part A of GST REG-01 a Temporary Reference Number TRN is generated. Click the REGISTER NOW link.

Separate OTP will be sent to this mobile number. How to check ARN Status. Enter the ARN or the SRN you have received on your registered e-mail idAt this stage you must also input Captcha code and.

On GST Portal go to Track Application Services under Services. Will be issued or query can be raised 127K views View upvotes Sponsored by FinanceBuzz 8 clever moves when you have 1000 in the bank. The GST Home page is displayed.

I some how dont have TRN in my mail box and mobile message box. To check the GST ARN status follow the steps below. Click the PROCEED button.

It took me more than 15 days to get my paperwork done. File Clarification within 7 working days of date of notice on portal. Now you need to Login into GST Portal via TRN Number.

Application Status Using TRN. After entering Temporary Reference Number and Character. If you cannot retrieve TRN from Mail or phone due to any reason you need to fill in all the details in PART A of the Registration Application again.

Clarification filed-Pending for Order. You will get an option to enter either ARN or SRN. In the main menu click on Track Application Status under Services.

This number is used to fill part B of form GST REG-01. Permanent Account Number PAN Email Address. Enter the ARN number in the field provided and complete the CAPTCHA.

How to Login after generating TRN temporary reference number in GST website TRN कय ह. Enter the correct name of the business Type at least 10 characters to. An OTP would be received by Email and Phone.

MY TRN NUMBER XPYRY 22180005587TRN. Email Address is required Enter valid Email Address. Click the REGISTER NOW link.

After clicking Track Application Status you will arrive on this pageSelect Registration from the dropdown. Then system says that in such a case while logging using these credentials system will display your TRN. You will get 15-digit Transaction Reference Number TRN.

Pending with Tax Officer for Processing.

What Is The Difference Between A Tin Number And A Gst Number Quora

Gst Registration Status How To Track Gst Status Quickbooks

Gst Registration Process Online Guide For Gst Registration Indiafilings

Gst Registration Status How To Track Gst Application Status

How To Get Gst Number Online For Your Business

How To Register For Part A Gst Temporary Reference Number

Check Gst Registration Status On Gst Portal Learn By Quickolearn By Quicko

Posting Komentar untuk "How To Find Trn In Gst"