How Does A Reversionary Pension Work

It takes effect as soon as your liability as trustee to pay periodic pension payments to a member has been substituted in full with a liability to pay them a lump sum instead. Once you retire you earn the accrued pension money divided into monthly checks.

2016 Smsf And Estate Planning Insights

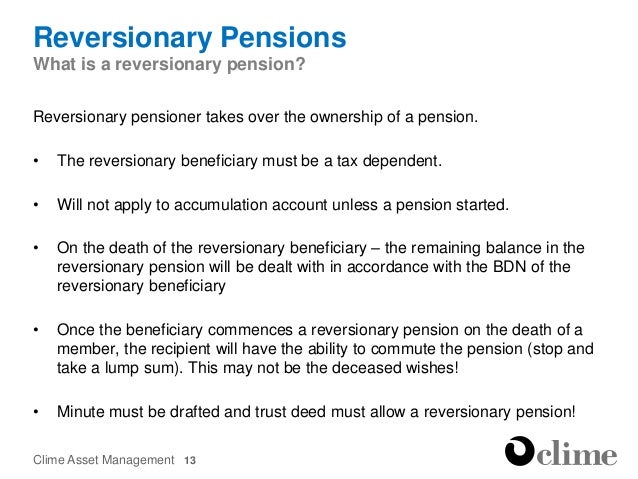

A reversionary pension is an income stream pension that automatically passes to the reversionary beneficiary upon death of the original owner of the pension.

How does a reversionary pension work. This means that in the event of your death the Account-Based Pension will automatically continue to be paid to your wife. The earnings on funds that support TTR pensions are still taxed at 15 unlike the funds that support your super pension are when you have retired. In most cases a formula determines the amount you receive.

A retirement income strategy that combines an insurance policy with an immediate annuity to provide for a surviving spouse. After employees retire they receive monthly benefits from the plan based on a percentage of their average salary over their last few years of employment. How the TBC works differs between reversionary pensions income streams that automatically continue upon the members death to a nominated dependant beneficiary and non-reversionary pensions.

The earnings from assets set aside to support the pension the pension payments made any commutations lump sums made from the pension account. A workplace pension is a way of saving for your retirement thats arranged by your employer. The formula also takes into account how.

Pension plans require your employer to contribute money to your plan as you work. You have elected to have your wife as a Reversionary Pensioner for your Allocated Pension Account-Based Pension. Some workplace pensions are called occupational works company or work-based.

A reversionary pension beneficiary is a person who will receive an income stream pension when the original owner and recipient of the pension passes away. Minimum payments You must make payments at least annually and meet the minimum pension payment amounts. Each qualifying year you add to your National Insurance record after 5 April 2016 will add a certain amount about 513 a week this is 17960 divided by 35 totals do not sum due to rounding.

How does a pension plan work. Non-reversionary pensions In many cases a pension is set up as non-reversionary with the SMSF trustee having a discretion in the deed to revert a pension on death. A reversionary pension is an income stream you set up with your superannuation that automatically continues to someone else generally your spouse when you die.

You can record them in trustee minutes. Some of the formula variables include your age compensation and years of service to the company. You must start a TTR prior to turning 65.

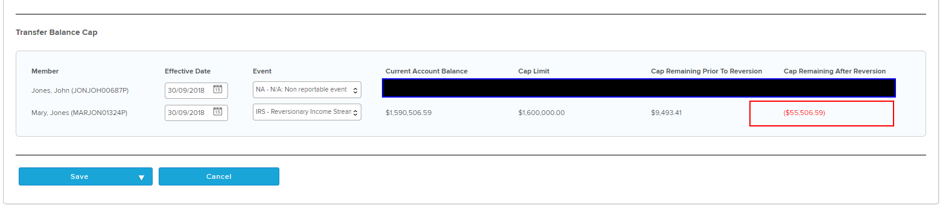

The pension received by the reversionary beneficiary is exactly the same as the pension in payment to the original pensioner. The value of the pension counting towards a beneficiarys TBC and the timing of when it counts is different between these two types of pensions. A market linked pension TAP that reverts to a surviving spouse will therefore remain a market linked pension even once it has passed to the spouse and cannot be converted to a more flexible account-based pension.

Reversionary Bonus A traditional insurance policy if in forcefully paid shall participate in the profits of the companys policyholders fund from the commencement date of the policy. A reversionary pension is an income stream you set up with your superannuation or SMSF that automatically passes to your chosen reversionary beneficiary such as your spouse on your death. The account-based pension therefore ceases at this time.

Provided your intended beneficiary is an eligible death benefit dependant at the time of your death they will start receiving your pension immediately. It gets a share of the profits in the form of bonuses. A pension that is reversionary from the outset is also called an auto-reversionary pension ie it automatically reverts on the members death to their reversionary beneficiary.

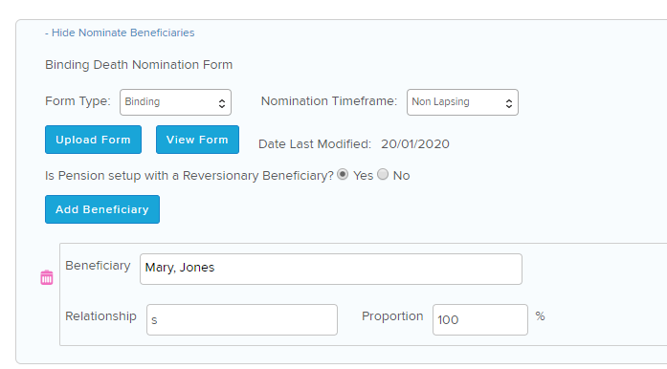

If the Allocated Pension was setup as a reversionary Allocated Pension then it will automatically revert to the reversionary beneficiary without passing through your estate or being distributed as part of a binding or non-binding death benefit nomination. Document these at the time the payment is requested. Aug 14 2020.

This is a pension you can commence if you have reached your preservation age but are still working. As soon as you reach the age of 55 57 from 2028 you can take your pension from any of our plans online through PensionBee drawdown. Similar to a permanent life insurance policy.

Transition-to-retirement pension TTR or TRIS. These bonuses declared regularly and paid at the end at the time of claim are called reversionary bonuses. The liability to pay the lump sum arises as a.

There are no forms to sign as everything is done digitally and paying out your cash typically takes 7-10 working days. A reversionary pension recipient regardless of age and your late spouse was over 60 you are eligible for the 10 tax offset on the pension from an untaxed source. If you would like to claim this offset.

How the transfer balance cap works differs between reversionary pensions income streams that automatically continue upon the members death to a nominated dependant beneficiary and non. If eligible these tax offsets will be applied to your pension fortnightly. With a reversionary pension your existing super pension continues to be paid but it reverts to your beneficiary.

Reversionary Pension Vs Bdbn Which Outcome Is Preferred

What Is A Reversionary Pension Leading Smsf Law Firm

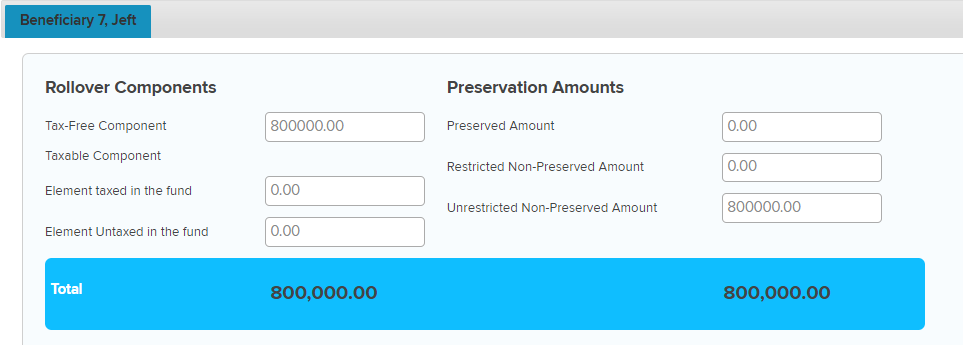

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

Reversionary Pensions What Are The Pros Cons Canstar

How To Start A Reversionary Pension Simple Fund 360 Knowledge Centre

Posting Komentar untuk "How Does A Reversionary Pension Work"