Is Demat Account Compulsory For Sgb

Demat account is must for buying or selling stocks from the stock market. No SIP one-time payment during the subscription period.

Can We Buy Soverign Gold Bond Without Demat Account Quora

If you hold the SGBs in the demat account it is the responsibility of depositories to credit your bank account with interest income.

Is demat account compulsory for sgb. With respect to your question I am not very sure. However transaction volume taking place are very less in majority of SGB tranches. Demat requests received from client registered owner with name not matching exactly with the name appearing on the certificates merely on account of initials not being spelt out fully or put after or prior to the surname can be processed provided the signature of the client on the Dematerialisation Request Form DRF tallies with the specimen signature available with the.

Can I get the bonds in demat form. You dont get an SGB certificate when you invest via a Demat account and opt to hold the SGB on the exchange. This is because to trade in the stock markets you need to be registered with the stock exchange.

Till the process of dematerialization is completed the bonds will be held in RBIs books. All SGB tranches are listed and traded in the cash market of BSE and NSE. Is nomination compulsory for a demat account.

While this offer carries an annual interest rate of 250 to investoRs Capital gains if any at maturity is tax-free. After your demat account is opened your DP will provide. Interest to be received 25 per annum payable half yearly.

As per sub rule 1 of Rule 9A of CompaniesProspectus and Allotment of Securities Third Amendment Rules 2018 a every unlisted public company shall issue of securities only in dematerialized form. No permission is required from RBI to open a demat account. If you have a demat account it is preferable to get holdings of your SGB in your demat format so you can trade the same on exchange.

The interest payment of 25 per annum is paid to you by RBI half yearly. Where as Trading account is used place Buy and Sell Orders in Stock Exchange and its Interlinked with Demat Account Automatically. A specific request for the same must be made in the application form itself.

Having gold in ones portfolio will help in diversifying risks particularly if one has a long-term the investment horizon. But in case you dont have a demat account and you are applying SGB via Bank or Post office you will get a Certificate of Holding on the date of issuance of the SGB. The advancement of technology has made this possible and NPS bonds corporate FDs and even insurance policies can now be held in Demat form.

A trading account and a demat account are compulsory for buying or selling SGB in secondary market. Demat physical and e-certificate. With the Help of it you Can Trade and Invest in StocksShares of Companies Directly.

Because the ownership is interchangeable in this case. While it is mandatory to have a Demat account for shares nowadays stock exchanges have come up with the option of holding mutual funds in Demat form also. Gold bonds are available in three different formats.

A Sovereign Gold Bond SGB is a gold investment that is not physical. Ans No Demat accounts are primarily for the online transaction of shares on a stock exchange. This means that if you want to buy or sell shares from the stock market in India it is mandatory to have a Demat account.

You need to fill up a form submit PAN card and proof of address. A Demat Account is an account that is used to hold shares and securities in electronic format. The current gold price is reflected in the.

In addition you need to provide details of your bank account. For this demat holding is compulsory. This is an exclusive benefit available on gold bonds.

In that case you dont have any locking period. Stock brokers are registered members of the exchanges. The bonds can be held in demat account.

Investors should open an account through a SEBI registered stock broker. Trading and demat account is a must for investing in the stock market. The Reserve Bank of India RBI issues sovereign gold bonds on behalf of the Indian government.

Is Demat account mandatory for Sovereign Gold Bond SGB. Conversion of demat account status on change of residential status of customer Application is ASBA IPO and SGB using demat For any forms required Click Here to download and submit at nearest Demat Servicing branch. May I invest in gold bonds through SIP or it is a one time payment.

So plan purchase atleast a few days in advance. Analysis of Notification on Compulsory Dematerialization of Shares of Unlisted Public Company 1. Thus if an investor chooses to apply for an issue that is being made in a compulsory demat mode he has to have a demat account and has the responsibility to put the correct DP ID and Client ID.

Yes to buy a sovereign gold bond you dont require a demat account. Opening a demat account is quite simple. Yes Demat account is now mandatory for SGB.

How much interest will I receive. The holding is a book entry at RBI who is the issuer of this bond. When you buy SGB from any financial institute then it is always preferable to mention your Demat account information so that you hold SGB in your Demat account and can be traded on NSE like stocks.

As I understand the bond must be in your demat account on the due date. Is a Demat account compulsory for availing a systematic investment plan. SGB services 11B Services Service request has been forwarded successfully for processing Demat File Upload DMTUPLD Step Provide Upload Information which hes to be u o Step Verity Confirm V infonmstion sn mske che Execution Status Note the num 1 of3 Execution Status Service Reference Number Iteration Serial Initiate new request.

The facility for conversion to demat will also be available subsequent to allotment of the bond. All you have to do is to approach a NSDL DP which will help you to complete the formalities. Shares can be sold or purchased only through Demat.

Thus if you intend to apply for an issue that is being made in a compulsory demat mode you are required to have a demat account and also have the responsibility to put the correct DP ID and Client ID details in the bidapplication forms. As per the requirement all the public issues of size in excess of Rs10 crore are to be made compulsorily in demat mode. You do not require a demat account to buy SGB.

Just the way you can sell a stock or ETF on BSE and NSE exchange you can now trade SGB as well. SEBI has mandated that nomination should be recorded for a demat account held by individuals. SGB Sovereign Gold Bonds withdrawal option Secondary market route.

Also since more than 99 of the settlement at the stock exchanges is taking place in the demat form it is advisable that securities be held in demat form with any. However credits and debits from demat account may require general or specific permissions as the case may be from designated authorized dealers. You can buy it from your bank using ebanking.

Each bond is worth one gramme of 999 pure gold. Company Shall Issue New Securities Only In Demat Form. Due to online the process is so seamless that you wont even realize how fast it happens.

The stamp duty to be paid on transfer of securities is not needed all risks associated with physical certificates like fake securities forgery bad delivery etc.

Want To Invest In Stockmarkets Open Free Trading And Demat Account With Leading Stock Broker Create Wealth With Exp Stock Broker Investing Capital Market

Buy Sovereign Gold Bond Online Sbi Kotak Icici Hdfc Bank

Can I Buy Sovereign Gold Bond Without Demat Account

Icicidirect Review 2021 Best Bank To Open Demat Account

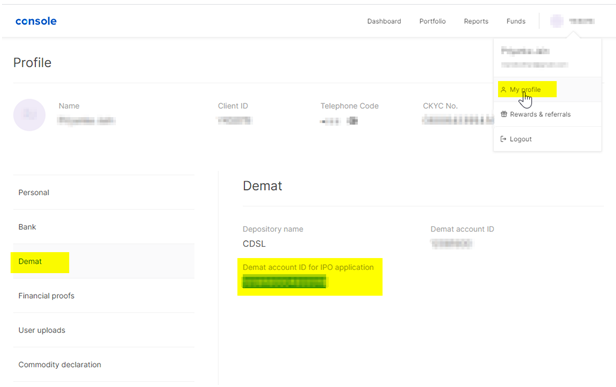

How Do I Find My Demat Account Number In Zerodha

Can I Buy Sovereign Gold Bond Without Demat Account

Can I Buy Sovereign Gold Bond Without Demat Account

Posting Komentar untuk "Is Demat Account Compulsory For Sgb"