How To Find Arn No In Gst

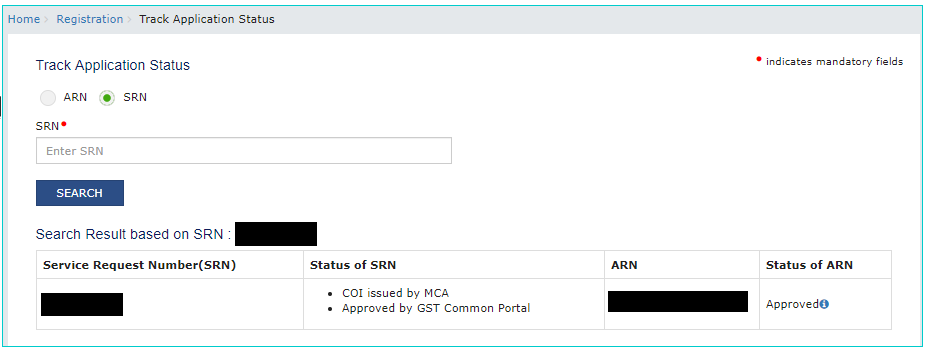

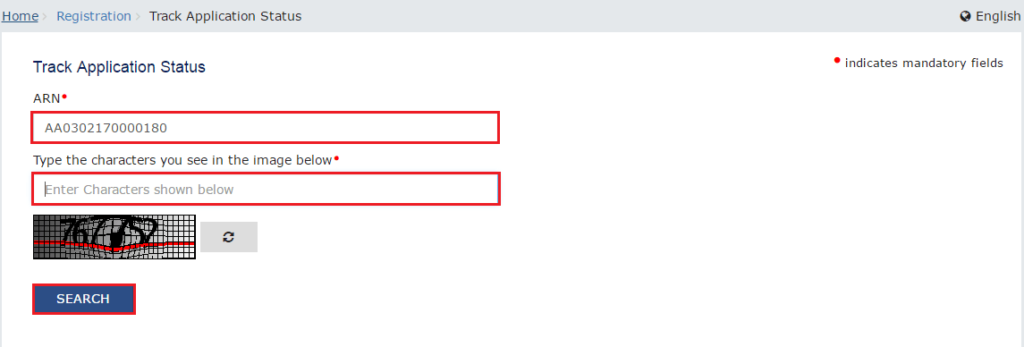

In the main menu click on Track Application Status under Services. HOW TO CHECK THE APPLICATION STATUS OF THE GST ARN.

Check Gst Registration Status On Gst Portal Learn By Quickolearn By Quicko

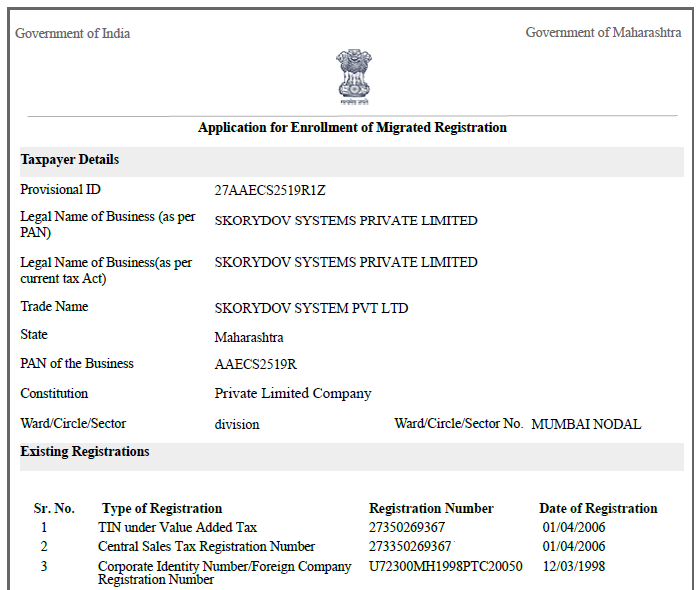

In the meantime you can check the GST registration status using your Application Reference Number ARN on the GST official portal.

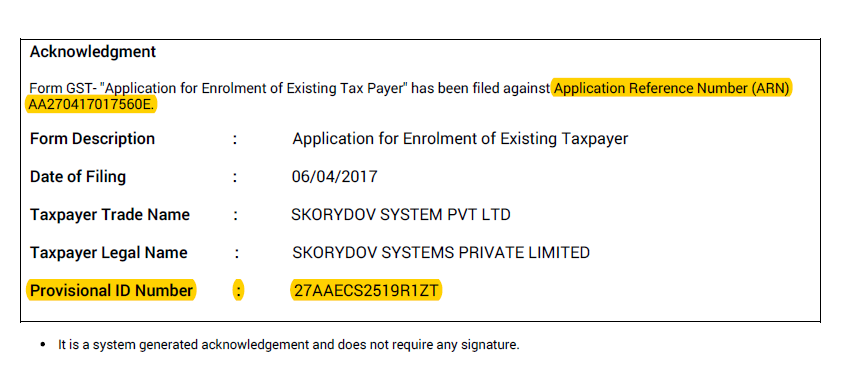

How to find arn no in gst. In case if you do not receive ARN an e-mail will be sent to you in this regard within few minutes. Check GST Registration Status via ARN number. Application status gets displayed along with other details like submission date assigned to form number and form description.

To view status of your ARN perform the following steps. To track return status perform the following steps. After receiving OTP PAN is verified at GSTN Portal.

Pending with Tax Officer for Processing. First of all Access the GST Portal or wwwgstgovin URL. Select ARN option and then enter ARN in the ARN field.

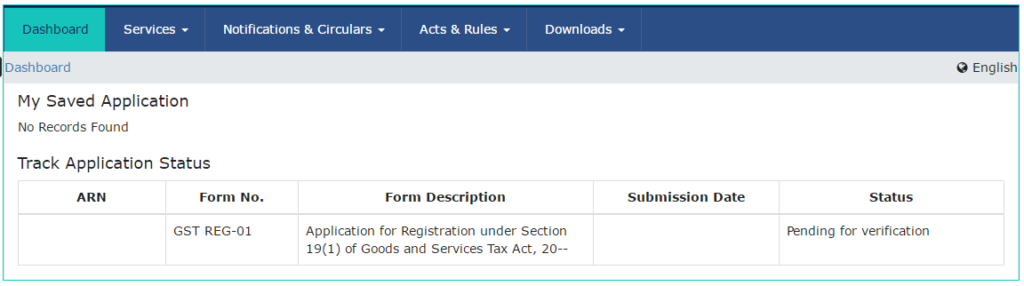

After entering the TRN number a page will appear mentioning the ARN Number and Status The status would be Pending for Clarification. As a registered taxpayer you will receive an Application Reference Number ARN on the submission of the return. File Clarification within 7 working days of date of notice on portal.

Clarification filed-Pending for Order. To check the status of your ARN number first you require a few documents for registration. You can track status of your application by tracking this ARN.

After clicking on the Services tab now click on Track Application Status. How to check GST return status as a registered taxpayer. Check the Arn in Liability Register of Your portal open the DRC 03 by providing the same click on Save before Filing for EVC.

The next involves entering the ARN number and pressing the Search button. Get detailed information on GST ARN status at Finserv MARKETS. On submission of the gst registration application you will be given an Application Reference Number ARN.

The first step is to access the home page of the GST portal at wwwgstgovin. And says that the same were sent on email and mobile. July 8 2020 at 400 pm Nikhil says.

Unfortunately system does not show the TRN. Second Way to download GST Registration Show Cause Notice. Please check the procedure as stated above you will find the ARN in My Applications.

For more information we suggest taxpayers to refer gstgovin. On submission of the gst registration application you will be given an Application Reference Number ARN. To check the GST ARN status follow the steps below.

Click on Pending for Clarification Show. What is ARN Number. An email will be sent to you on the mentioned email id in case you do not receive an ARN number after completion of the process.

A confirmation message will be sent to the candidate in FORM GST REG-02 electronically. Further there is no such acknowledgement as you people are asking for. First login with your account details on GST portal then Click on the Dashboard My Saved application command where you can see your ARN status.

I have received gst no on dated 05-july-2020 arn noLet me know one thingFor registrarion anything will do for further process as to submitted the form in sales tax office this type of process. To view status of your ARN perform the following steps. How to gen Application Reference Number after registration on GST portal and How to know my GST ARN number from GST website or How to check my ARN.

After doing so click Search button. After submitting the applicant successfully at GSTN portal the candidate will be allotted Application Reference Number ARN number on the mentioned mobile number or e-mail. Notice for seeking clarification issued by officer.

I some how dont have TRN in my mail box and mobile message box. You can track the status of your application by tracking this ARN. You can check status of your ARN at the official GST portal from you have enrolled.

You may write to GSTN in this regard if you are facing such issues at border. How to get ARN number under GST tax - YouTube. How to check GST Registration Status- ARN application Go to the GST Portal Register with your details Click Services Registration Track Application Status Enter.

Then system says that in such a case while logging using these credentials system will display your TRN. Acquirer reference number ARN is a unique number that tags a credit card transaction when it goes from the acquiring bank to the cardholders bank. You can track status of your application by tracking this ARN.

The second step is to click on the Services tab on the top bar. On submitting the form the status of the ARN number is displayed below. Once you have obtained a GST ARN number the status of the GST ARN can be checked online on the GST Portal.

GST ARN Status - Learn how to check using GST registration status using ARN. The ARN is the official proof of the GST registration being complete. There is no way as such to know the status of LUT on GST portal only an ARN is generated which is the acknowledgement and one can download the.

Check Gst Registration Status On Gst Portal Learn By Quickolearn By Quicko

Check Gst Registration Status On Gst Portal Learn By Quickolearn By Quicko

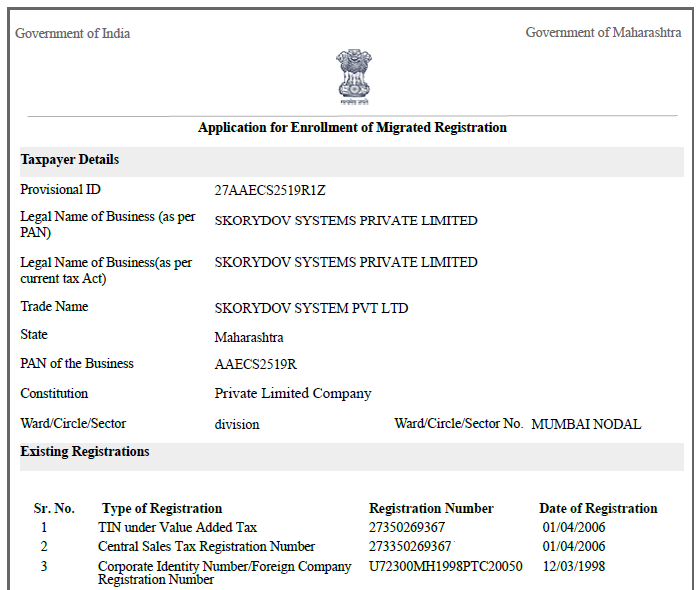

Arn Application Reference Number Its Usage In Gst Registration

Arn Number And Gst Provisional Id Acknowledgment Gstplus Helpcenter

How To Check Gst Arn Status Online Indiafilings

Gst Registration Online Gst Registration Process In India Enterslice In 2020 Registration How To Apply Goods And Services

Arn Number And Gst Provisional Id Acknowledgment Gstplus Helpcenter

Posting Komentar untuk "How To Find Arn No In Gst"