How To Find My Arn Number In Gst

Notice for seeking clarification issued by officer. In the Username field type the username that you created.

How To Get Arn Number Under Gst Tax Youtube

In case if you do not receive ARN an e-mail will be sent to you in this regard within few minutes.

How to find my arn number in gst. After doing so click Search button. Besides the status will get sent to your verified mobile number. In the main menu click on Track Application Status under Services.

After sucessfully submation of GST registration application every person want to kmow status of GST registration. You will be shown the status of the application. Check GST Registration Status via ARN number.

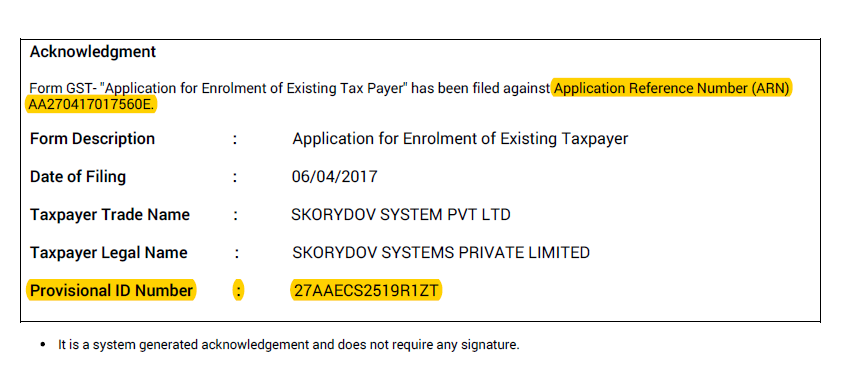

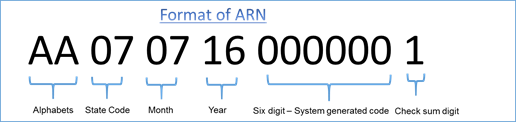

Use this ARN to track your GST Application. On submission of the gst registration application you will be given an Application Reference Number ARN. Click the EXISTING USER LOGIN button.

Please try again later. Go to this link httpswwwgstgovin Click on Existing User Login Button. Enter the Captcha shown in the box.

To Search for the ARN status of the GST application numbers all over India the applicant should type their ARN number and can check the application status of the UINGSTIN. How to check ARN Status. Acquirer reference numberARN is a unique number that tags a credit card transaction when it goes from the merchants bank the acquiring bank through the card scheme to the cardholders bank the issuer.

Select ARN option and then enter ARN in the ARN field. Also your ARN Number Status will be sent to your registered mobile number. Click Saved Application on top tab.

My ARN is AA2707171186133 DATED 05072016 but still not issued GSTN status showing pending for order i am not able to purchase raw material from last 15 business is totally stopped then again i have submitted fresh application on same PAN on dated 16072017 ARN is AA2707172390725 but this one also showing pending for processing so please co operate and. After successfully submitting a GST registration application an ARN number is generated on the GST Portal. The following are the step to know GST registration status.

GST ARN status check can be done online using the official website of GST which is httpswwwgstgovin. The GST Home page is displayed. If playback doesnt begin shortly try restarting your device.

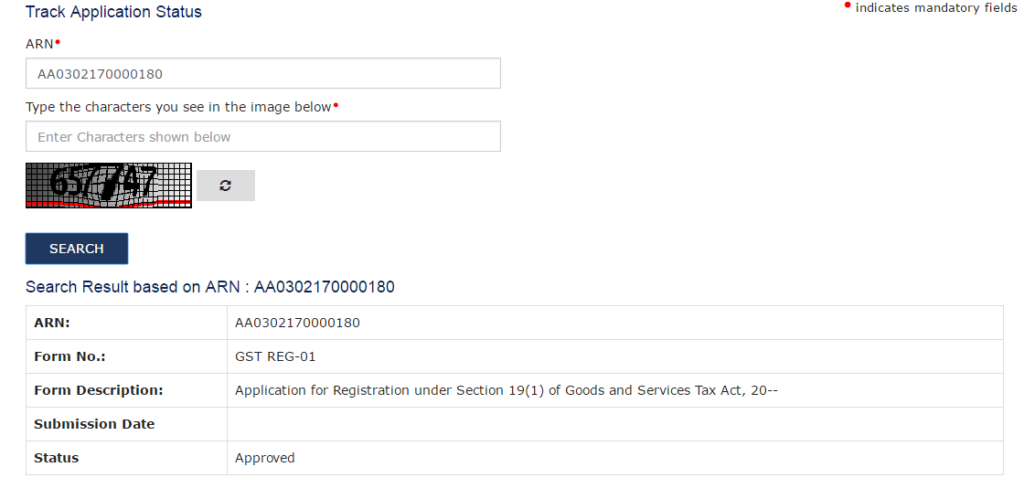

How to Check Application Status by ARN Number. To Track The Status of GST Registration with the ARN Number You Need To Follow The Below Listed Steps. After the ARN number being generated the taxpayer needs to wait for 3 to 5 working days to get the GSTIN number from the government.

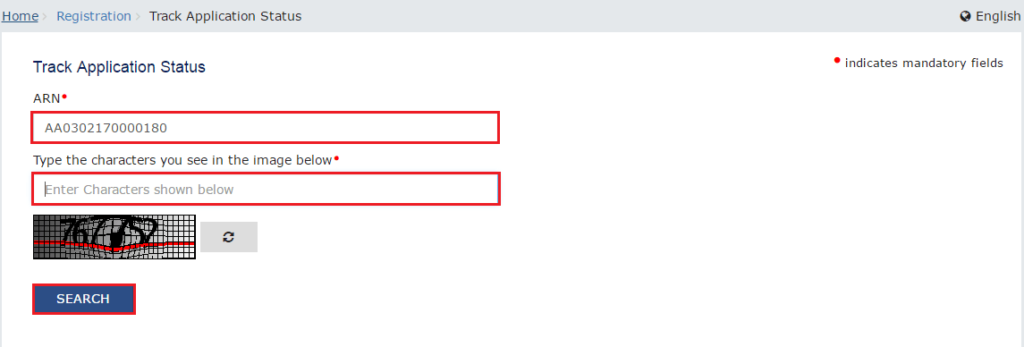

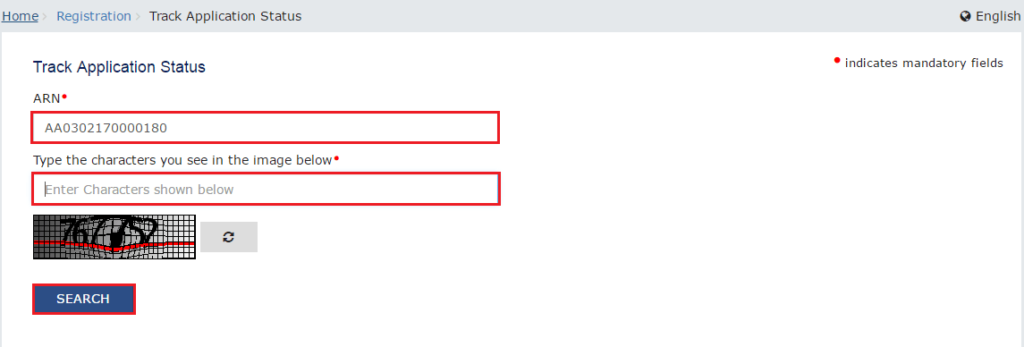

You can check status of your ARN at the official GST portal from you have enrolled. How to check GST Registration Status- ARN application Go to the GST Portal Register with your details Click Services Registration Track Application Status Enter the ARN you received Enter captcha code and click om search. After the successful submission of GST Registration application you will receive an ARN Acknowledgment Reference Number.

How do I check my GST registration with Arn number. The dashboard opens. Enter the ARN number.

After clicking on the Services tab now click on Track Application Status. Open the website to access the GST portal by entering the login credentials to track GST application status. Answer 1 of 2.

To check the GST ARN status follow the steps below. The second step is to click on the Services tab on the top bar. Enter ID Password and Captcha.

It is mandatory to cross check GST Number of Customers or vendors to make sure that GST number provided by customer or vendors is valid or not before filing. Once you have obtained a GST ARN number the status of the GST ARN can be checked online on the GST Portal. After filing the GST REG 1 on gstgovin the ARN number gets generated.

Enter your ARN number. Click the dashboard and move to My Saved Application icon and click it. Upon entering your ARN number you will see your application status.

To view status of your ARN perform the following steps. One of my client has found a mistake in March 2019 sales amount and he had paid the difference tax amount through DRC 03the set off was cleared and he filed the above form through EVC but he didn t received any ARN Please describe the process to get - GST. Below you can find the steps to check your GST application status.

Pending with Tax Officer for Processing. On submitting the form the status of the ARN number. You can track status of your application by tracking this ARN.

Login on GST portal. Access the wwwgstgovin URL. My Application Status page opens.

Click on the search tab. File Clarification within 7 working days of date of notice on portal. Application status gets displayed along with other details like submission date assigned to form number and form description.

Essential Announcement from GST Portal. Go to the link- httpsservicesgstgovinservicesarnstatus. For more information we suggest taxpayers to refer gstgovin.

What is ARN Number. This number can be used by issuing banks to trace a transaction with a. The next involves entering the ARN number and pressing the Search button.

The first step is to access the home page of the GST portal at wwwgstgovin. Clarification filed-Pending for Order. Click Continue Button on next page.

Application Status will be displayed. The Login page is displayed. In the meantime you can check the GST registration status using your Application Reference Number ARN on the GST official portal.

Acquirer reference number ARN is a unique number that tags a credit card transaction when it goes from the acquiring bank to the cardholders bank. How to check check gst registration status by ARN. Use Track GST Application by ARN tool.

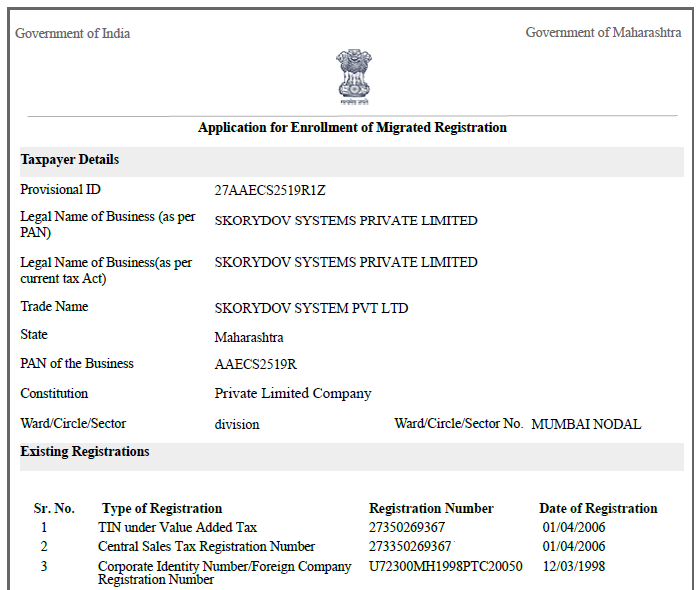

Arn Number And Gst Provisional Id Acknowledgment Gstplus Helpcenter

How To Track My Fund Transfer With Arn Number Quora

Arn Number And Gst Provisional Id Acknowledgment Gstplus Helpcenter

How To Check Gst Arn Status Online Indiafilings

Arn Number Under Gst Tax Payment System In India

Posting Komentar untuk "How To Find My Arn Number In Gst"